Your Simple Step-By-Step Plan

You Can’t Control Everything… But You Can Make Sure Your Kids Aren’t Raised by Creepy Uncle Carl (or Your Assets Aren't Stuck In a System You Don't Support)

Learn the Legal & Financial Steps to Ensure You AND the People You Love Are Financially and Legally Secure, No Matter What.

As featured on:

Dear Friend,

Let’s skip the guilt trip.

You’re doing your best. You’re working hard to create a beautiful life. You’ve supported people you care about deeply.

But if something happened to you tomorrow… would your loved ones know what to do?

Would your minor children end up in the care of strangers, even temporarily while the authorities figure out what you would have wanted?

Would your adult children or loved ones be left trying to piece together your financial picture, searching for accounts they can’t access, passwords they don’t have, or assets they didn’t know existed?

Would the money you worked so hard to earn be tied up in court for months—or lost to taxes, fees, or legal confusion?

Would someone you love be left powerless, heartbroken, and stuck in a system that really doesn’t care?

If you’re not 100% sure… keep reading.

Because you’re not alone. And this is fixable.

Imagine If You Could...

Feel Smart and Confident about every legal and financial choice you make for your family!

Ensure your children will be cared for by the people you want, in the way you want - by the people you choose - and never taken into the care of strangers, no matter what

Keep your money in the family (and away from the government)! We’ll share the secrets of “generational wealth” you’ve likely never learned

Save money on your biggest family expense- taxes

- through your own understanding of the tax system and how to play the game as well as the wealthy do!

Override the government’s plan for you with the plan YOU choose for yourself!

Understand exactly how to play the financial and legal game to win!

Hi My Name Is Ali Katz

I am a lawyer, founder/CEO, bootstrapped entrepreneur and devoted matriarch who loves dancing, teaching, creating new systems for our collective future, and spending lots of time in the beautiful mountains of Boulder ⛰️ and oceans of Costa Rica 🌊, where I live with my extended chosen family.

I founded the Eyes Wide Open Collective to support heart-centered humans in learning how to create lives worth living in right relationship with ourselves, each other and the planet by remembering who we are, why we are here, and what’s ours to do while leveraging all of the (often hidden) resources available to us.

I Spent So Many Years Lost...

... Confused and struggling as a single mom, with such a strong desire to show up for my kids and myself, and make smart choices with my resources, while staying devoted to being present for my kids and building my businesses along the way.

Even though I had been to law school, graduated top of my class and worked at one of the best law firms in the country, I still made legal and financial mistakes that cost me more money than most people will ever make in their lives - to the tune of $2M+, driving me into bankruptcy - even after being a family, financial and legal expert on television.

With the benefit of hindsight, I can see I made those mistakes so I could learn for the benefit of all of us, so you don't have to make the mistakes I did.

Now, at 50 with my kids grown and thriving...

... And my 8-figure portfolio of companies nearly running themselves... I have the time, energy, attention and money to share everything I’ve learned with you in the most affordable, accessible way possible.

My greatest desire is to live the second half of my life in utmost service to educating the most number of people with the frameworks, systems, philosophies and understandings I’ve gained around our legal and financial system so we can collectively step into our sovereignty, heal the scarcity in our economic, legal and financial systems, and unite in service to the world we most desire.

By Waking Up & Empowering Ourselves

With the financial and legal knowledge I will share with you, we can turn the tides for ourselves, our families and all beings we touch. I love helping moms and dads because you have the most to lose and gain, and the most care about your life now, and your future legacy.

Legal and financial literacy (and ultimately wellness) is the gateway to becoming the kind of confident, secure adult who can raise healthy, prepared humans and take care of the senior generation in a good way. I love helping seniors learn to trust their adult kids, and helping the junior generations rise up to invite their parents into a new level of trust.

I love ensuring assets transition from one generation to the next in the best way possible...

... With the least expenditure of time, energy, attention and money.

And now I want to teach you how you can make the very best legal and financial decisions for yourself and your family...

Even if you...

• Don’t have a whole lot of money right now

• Feel as if you don’t have the time to focus on legal and financial matters

• Are intimidated by the words “legal and financial”

• Have ADHD and get distracted by all the other more

important things that seem to take priority

This Is YOUR Time!

You Are READY to Be In Control of Your Legal & Financial Future!

A Step-By-Step Course to Ensure Your Family's Security

Learn How to Secure Your Family's Future with Just a Few Hours of Simple, Guided Steps!

How Does It Work?

Introducing the LIFTed Family Course… The comprehensive guide that provides you with a step-by-step system to ensure your family’s financial and legal security.

This course includes video trainings, practical guidance, and an action planning guide to help you manage your resources, protect your family, and secure your future.

Open A New World Of Legal & Financial Peace Of Mind!

This Is For You If...

You want to know you’ve made the right legal and financial choices for yourself and your kids.

You want to educate yourself more than your parents did, and give your kids the financial literacy foundation you may not have had.

You have assets you want to protect for your kids via effective legal planning.

You really want to feel confident and secure financially.

You know life is unpredictable and it’s your job as a parent to be prepared for anything and everything.

You are ready now to put in the time and energy required to create a legal fortress to “futureproof” your family.

This Is NOT For You If...

You want to leave all of your legal and financial decisions to others to decide for you.

You feel certain you’ve got great legal, insurance, financial and tax counsel, and you have nothing more to learn.

You think the government’s got a great plan for you and your assets, and can just leave it all to fate.

You think a judge will do a better job than you at choosing who takes care of your kids and assets, if you die or become incapacitated, and want to leave it for them to decide.

You think you are immortal and nothing could ever go wrong to put you in a position where you can’t provide for your kids.

After 20+ years in estate planning, we’ve helped countless clients step into responsibility and security.

KC Baker

Mother of Two

"I’m so grateful for your guidance in getting the house into the trust - it has positively transformed our relationship dynamic. Completing the trust work this summer brought me immense peace of mind. You've helped me see the importance of getting everything in order so we can leave things for those we love in a meaningful way if something happens.

Get access to a proven blueprint To Transform Your Family's Financial Future.

Everything you need to create a secure and prosperous future for your family!

LIFTed Family Course!

Join our one-of-a-kind learning platform where you will learn from a top legal and financial expert on how to protect your family's assets and legacy!

✅ Instant Access to the Complete LIFT Protection Framework: Start protecting your family immediately with our comprehensive LIFT (Legal, Insurance, Tax, Financial) framework, designed to guide you in creating a personalized family protection plan.

✅ Confidently Master Estate Planning: Learn essential estate planning strategies from top legal experts, and secure your family’s future with easy-to-follow guidance, even if you have no prior experience.

✅ Effortless Asset Protection and Financial Security: Discover how to safeguard your family’s assets with proven methods, ensuring financial security and eliminating legal uncertainties from day one.

✅ Quickly Implement Your Family’s Protection Plan: Accelerate your planning process with actionable steps that allow you to secure your family’s future faster than you thought possible.

✅ Ensure Your Kids Are Always Cared For: Use the comprehensive Kids Protection Plan® to guarantee your children are raised by the people you trust, with legal templates and instructions to put your mind at ease.

✅ Financial Confidence for Your Family: Achieve daily financial security with a solid plan in place, protecting your family's resources and giving you peace of mind.

✅ Build a Legacy for Future Generations: Learn how to manage and grow your family’s legacy, ensuring your resources are protected and preserved for generations to come.

Experience all this and more as you embark on your journey to creating a lasting legacy for your family with the LIFTed Family Course.

The LIFTed Family Course Includes Everything You Need to Secure Your Family's Future!

PLUS Step-By-Step Expert Guidance - So you always Have Clarity on your journey!

What's Included Inside:

LIFTed Family

Video Lessons

Your video lesson partner to walk you through the most foundational elements of asset and family protection.

📺 INTRODUCTION: An Introduction to Family Protection

Get your feet on solid ground, ready to create and implement a plan to prepare your family for the future.

📺 Step 1: Fast and Effective Legal Protection

Why you need so much more than just a simple will. We'll show you how to choose & name legal guardians for your kids, set up a trust, and more!

📺 Step 2: Understanding Your Insurance Needs

Learn about the different types of insurance and clarify what kind you need, how much you need, and never get blindsided by unreasonable insurance commissions

📺 Step 3: Your Eyes Wide Open Journey to Financial Liberation

We’ve been sold a promise of “financial freedom”, but it’s a lie that keeps us trapped on a treadmill of uncertainty and dread… chasing a false dream. By choosing a path of financial liberation, you’ll feel fully empowered to create the financial reality you truly desire.

📺 Step 4: Smart Tax Strategies for Generational Wealth

Practical steps to take right now to ensure you are minimizing taxes across the board - through life and death.

📺 Step 5: Creating A Unique Strategy For Your Needs

Your family is unique, and while most lawyers and financial advisors may leave you with a one-size-fits all plan, the LIFTed Family Course will support you to custom tailor a plan for you and the people you love.

LIFTed Family Workbook

Comprehensive guidance on family legal and financial planning with interactive exercises, expert tips, customizable plans, visual aids, and ongoing support to secure your family's future.

Comprehensive Coverage: The workbook breaks down every aspect of family legal and financial planning into simple, actionable steps.

Interactive Exercises: Engage with hands-on activities that help you apply what you learn immediately to your own family's situation.

Expert Guidance: Benefit from insights and tips from top legal and financial experts, tailored specifically for families.

Customizable Plans: Create a personalized legal and financial strategy that fits your unique family needs and goals.

Visual Aids and Checklists: Use easy-to-follow charts, checklists, and diagrams to ensure no detail is overlooked.

Ongoing Support: Access additional resources and support to keep your plan up-to-date as your family's needs evolve.

When You Sign Up Today, You'll Also Receive These FREE Bonuses:

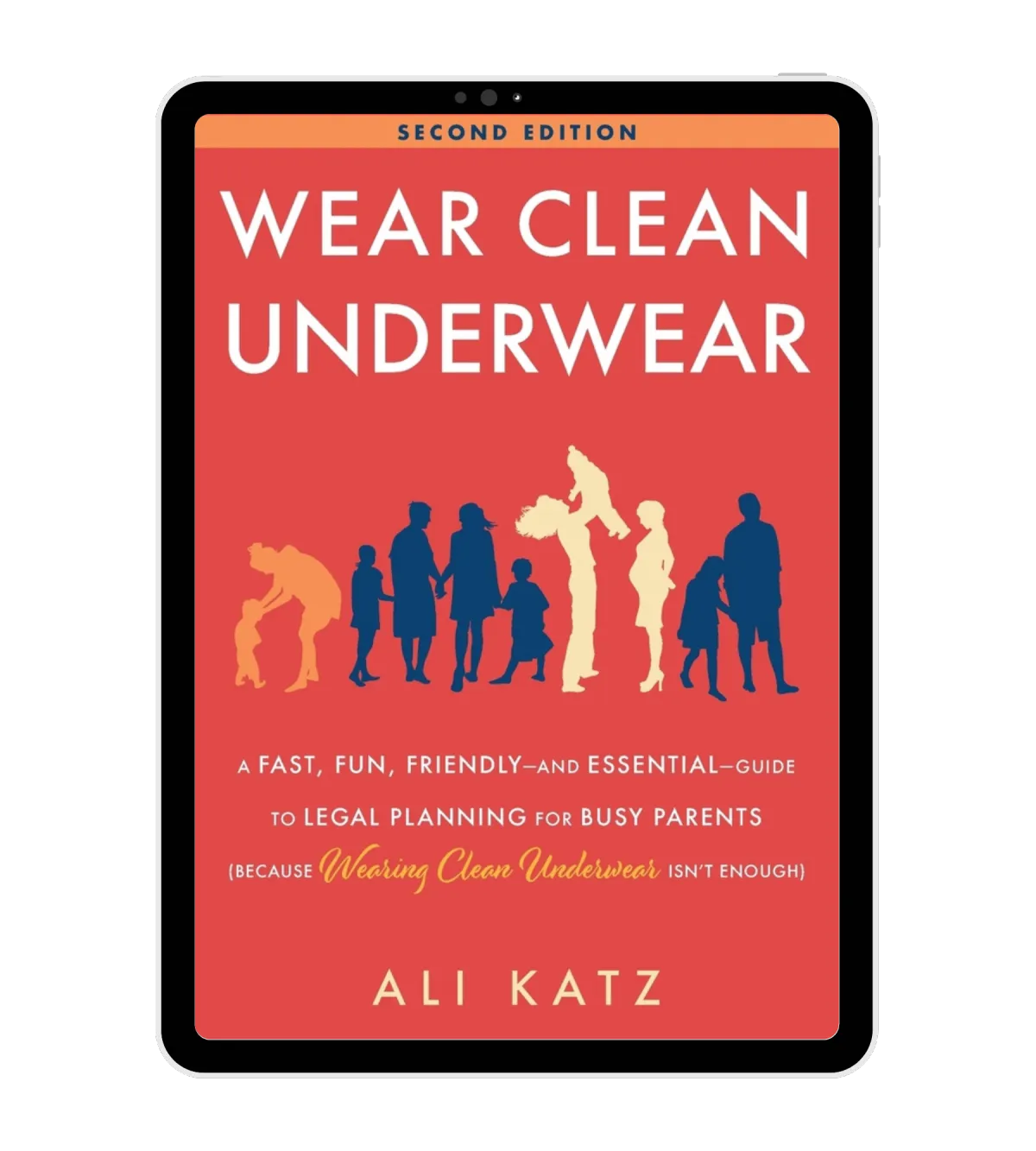

$16 VALUE

Wear Clean Underwear eBook

"Wear Clean Underwear" by Ali Katz is a practical guide for parents on essential legal and financial planning. It covers creating wills, naming guardians, and setting up trusts to ensure children's security if parents can't be there. Through relatable stories and clear advice, Ali empowers parents to safeguard their family's future, providing peace of mind and protection for their loved ones.

"Wear Clean Underwear" Will Show You:

What must be "on your fridge" in order to protect your kids

How to ensure your kids are raised the way you want them to be raised (even if you're not around to guide them)

Common mistakes most wills and estate plans make leaving gaps and holes which lead to legal chaos

How the “chain of guardianship” works and why each possibility must be clearly specified if you don’t want your children to end up in a foster home

How to confidentially exclude certain family members from assuming guardianship of your children

What factors to consider when naming legal guardians for your kids (It goes far deeper than blood relations)

Why “boilerplate” wills can be quickly written, and just as quickly thrown aside when they are needed most

The Great Will “Scam” - why are so many lawyers falling for this and allowing their clients to set up incomplete documents destined for trouble?

How to preserve the “intangible assets” that matter most (Most lawyers never think about this)

Why the “storage location” of most wills could end up with your kids getting taken to Child Protective Services

The 3 roles of a trust agreement, and how to set it up the right way

Why you need to keep your estate plan updated with legal changes (and how to set this on autopilot)

Why you need to consider what could happen if your spouse remarries after your death (almost no-one ever thinks about this, but if you truly care about your kids, then you must think about it and have a plan for it!)

How your choices can end up with your kids receiving 50% or even absolutely nothing from their inheritance if you don't set up your plan properly

The Shocking Truth About Wills: Discover why having just a will is like building a house on quicksand – and the vital step you’re missing that could change everything.

The Critical Mistake Most Parents Make:

Uncover a potential hidden time bomb in your family plans that could tear your loved ones apart – and the secret to defusing it.

The One Document That Guarantees Your Child’s Future:

Without this one document, your kids could end up with strangers – do you have it?

The Hidden Dangers Lurking in Your Estate Plan:

Outdated plans can doom your family’s future – discover how to shield them from disaster now.

$397 VALUE

Kids Protection Plan ®

Legal Guardian Nomination: Quickly and easily create a legal document to name guardians for your children in just 10 minutes, ensuring they are cared for by trusted individuals

Avoid Court and Conflict: Legally naming guardians keeps your family out of court and prevents expensive conflicts, ensuring a judge won't decide who raises your children or manages your assets.

Comprehensive Planning: The plan covers both long-term and short-term guardianship, caregiver instructions, and includes medical powers of attorney, ensuring your children are never taken into state custody and are raised according to your values.

$97 Value

AI Estate Planning Assistant

Instant Assistance: Receive immediate answers to your estate planning questions anytime, day or night, with our AI chatbot. Trained with insights from the "Wear Clean Underwear" book, it provides reliable, accurate guidance tailored to your needs.

Expert Knowledge: Access the expertise of a seasoned attorney at your fingertips. The AI Estate Planning Assistant delivers professional advice and tips, ensuring you make informed decisions every step of the way.

User-Friendly Experience: Enjoy a seamless, intuitive interface designed for ease of use. Whether you're setting up a will, naming guardians, or managing trusts, the AI assistant simplifies the process, making estate planning accessible and straightforward.

Now's The Time! Get Started Today!

The fastest and most effective way to make sure ALL the boxes are checked for your family.

Special Beta Launch Offer | Limited Time Only

$497 USD

✅ Secure Your Family’s Future with Comprehensive Guidance: Dive into our premium course, including the Family Protection Plan, Wealth Preservation Strategies, Insurance Insights, and Tax Optimization Techniques. Your peace of mind starts here!

✅ Immediate Access to a Proven System: Gain access to a step-by-step process designed to protect your family legally and financially. Transform your family’s future NOW!

✅ Empower Yourself with Valuable Support Materials: From detailed workbooks to interactive checklists and everything in between. We've got your back!

✅ Automate Your Family’s Security: Effortlessly manage your legal and financial planning with our pre-built templates, checklists, and more. Ensure your family's well-being while focusing on what matters most!

✅ Master Estate Planning and Financial Literacy: Unleash a full-fledged strategy that secures your assets and prepares your family for any situation. Includes personalized planning

✅ Exclusive Bonuses You Won’t Find Anywhere Else: Prepare to be amazed by our unique collection of extras. Designed to enhance your family's security!

✅ Transparent Investment: Only a $77 one-time fee for the LIFTed Family Course. No hidden costs, just transparent value.

Money-Back Guarantee

I believe in this system so much that I want you to feel completely confident trying it out.

That's why I offer a 100% Money-Back Guarantee. Purchase the LIFTed Family Course and start using all the included resources and tools.

Create your Personal Resource Map. Read or listen to my book.

Do it all. Go through it. And if afterwards you don’t experience a tremendous “exhale” mentally and realize how valuable this whole process was, then I will refund you no questions asked.

I stand behind every part of the LIFTed Family Course, and I'm here to help you every step of the way. So you can say yes right now, without any risk or hesitation.

Frequently Asked Questions

What is the LIFTed Family Course?

The LIFTed Family Course is the legal, insurance, financial and tax education and guidance you need to ensure you are making “eyes wide open” decisions, now and in the future.

Set up guardians for your children, ensure you have legally valid healthcare, legal and financial decision-makers for yourself, use your time, energy, attention and money (your TEAM resources) wisely.

LIFT your legal and financial literacy so you are confident that you are making the right decisions for yourself, and the people you love.

How does the course protect my family?

By understanding the actions you need to take to make wise decisions about legal, insurance, financial and tax matters for your family, you can chart an eyes wide open course for the highest and best use of your time, energy, attention and money.

Whether you need to simply name legal guardians for your children in the right way - avoiding the 6 common mistakes that even smart lawyers often make -- or you need a full asset protection plan to protect your family or business from lawsuits, you cannot just rely on legal, insurance, financial or tax advisors.

You need to get yourself the foundational education to understand what you can (and should) do yourself, and how to find and hire the right advisors when you need them.

The best way you can protect yourself, and your family, is to get educated. And to do it in a way that is fast, friendly and understands you are BUSY AF.

If I already have a will, do I need this course?

Yes, absolutely. Writing a will can be a great first step in creating a comprehensive plan for the care of your assets and your children, should the unthinkable happen to you.

But, it’s only a first step, and often insufficient. If that’s the case, you would be leaving your family with a big mess in the event of your incapacity or death.

The LIFTed Family Program guides you to evaluate your will, determine whether you’ve made any of the 6 common mistakes that even most lawyers make when naming legal guardians for kids in a will.

In addition, we will also cover the insurance, financial and tax planning foundations you need to have in place to ensure your family is taken care of, no matter what.

How do I know this course will help my family?

The LIFTed Family Program will only help your family if you buy it, then schedule 2 hours on your calendar to go through it, and another 1-2 hours to implement your LIFTed Family Plan.

If you go through it, and it doesn’t increase your knowledge, just email us, let us know you went through it, what we can do to improve, and we’ll send your money back. So, really, there’s no risk to your purchase. The biggest risk for you is procrastination, and then something happening when it’s too late.

The biggest gift I can give you beyond the knowledge in the LIFTed Family program is the gift of moving past your procrastination, and taking action, to do the right things for yourself and the people you love when it comes to your legal, insurance, financial and tax matters. And, to make it as easy as possible for you to do just that.

That’s what the LIFTed Family program is about. Your next step toward legal and financial literacy that creates a life worth living, and legacy you’re proud of leaving.

If You Skipped all the way to the bottom Of The Page For the main point, here It Is 😉:

Every parent has the same silent fear lurking in the back of their mind...

... "If something happens to me, what happens to my kids?

"How can I be sure they are protected and provided for after I'm gone?

Am I'm missing something?

What else do I need to do?"

If you love your family, then we need to have a weird conversation...

My name is Ali Katz, and I need to talk to you about your underwear...

... and why it's the KEY to setting your family up for lasting, thriving success no matter what the world throws your way.

I'll explain exactly what that means in a minute.

But first, some background...

I graduated first in my class from Georgetown Law, and have been a lawyer for 25 years.

And I've worked with some of the top law firms in the country, helping them prepare families with estate plans, wills, and asset protection plans. In my experience with hundreds of clients, at all levels of wealth

I've noticed most families are missing some crucial components of effective legal planning.

And overlooking just one of these components can lead to legal chaos for your family, in the event something goes wrong.

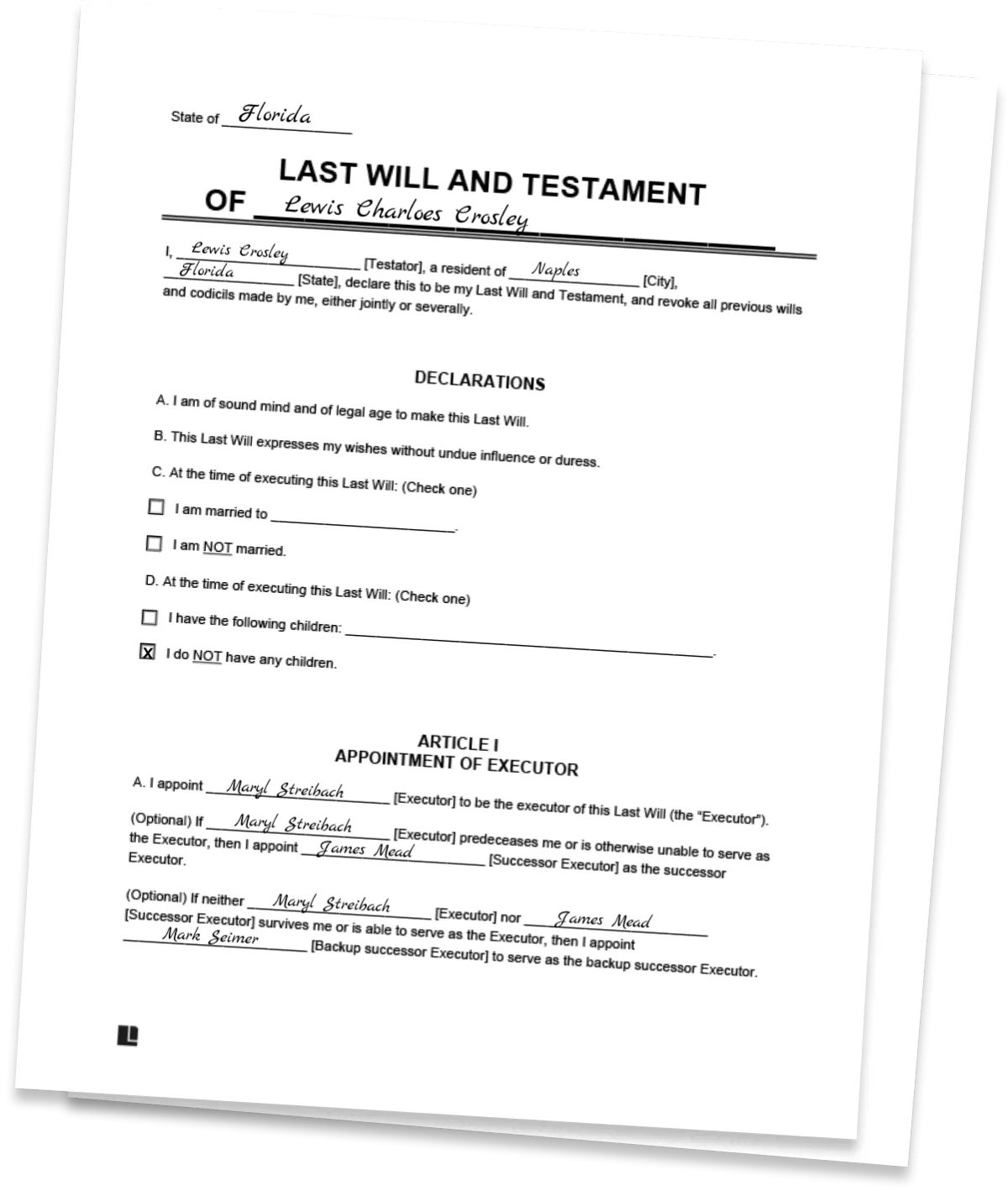

Lewis and our family had no idea how much a challenge executing his will would become.

I know how bad it can get... because I saw it happen within my own family.

Many years ago, my father-in-law spent $3,000 on an estate plan. He intended specifically to prevent us from dealing with probate court and specifically to avoid his ex-wife.

He thought he "had it covered"...

However, despite his efforts, after he died, we found ourselves entangled in probate and lengthy legal dealings with his ex-wife.

Even as a lawyer it was incredibly confusing and frustrating.

Initially, I thought his lawyer must have committed malpractice. However, upon further investigation and interviews with estate planning lawyers across the country, I found out we were not alone...

Joseph wasn’t alone in his mistakes. There’s currently $49.5 Billion in property sitting unclaimed in the United States.

I discovered that our situation was a common practice.

The plan my father-in-law had put in place was never updated, and his assets were not correctly managed to keep us out of court or away from conflicts with his ex-wife.

Even now, over twenty years later, there are still

assets stuck in Florida's Department of Unclaimed Property.

This isn't something anyone wants to think about...

but it's absolutely CRUCIAL to do it right, if you truly love your family and want to create a legacy of love and financial security for them. And that's just one part of the puzzle...

You also need to ask yourself, what will happen if I become incapacitated?

Does anyone know where everything is? (Passwords, accounts, crypto seed keys, documents etc.)

Do you want the government to take control of everything you own, because you didn't have a clear plan in place?

Again, no-one wants to think about it... but you MUST think about it and have a plan, if you want to be responsible and prepared.

My mom always had this weird saying…

“Make sure you wear clean underwear, in case you get in a car accident.”

For some reason, it stuck with me that no-one expects bad things to happen, like a car accident… but if you’re not prepared for it, then you can end up embarrassing yourself.

As I learned through my legal career, you can also create a lot of drama, strife and conflict for those you care about.

The good news is, I have made it easier than ever to make sure your underwear is clean...

At least when it comes to financial and legal peace of mind 😉.

Sign Up Today

LIFTed Family

Course

Make sure your children have the best life possible.

The most effective way to be confident knowing your family’s legal and financial future is fully secure

✅ Learn to protect and provide for your family with your eyes wide open

✅ Save thousands of dollars in expensive mistakes

✅ Name legal guardians for your kids

✅ A simple step-by-step financial plan for you to follow

✅ Unlock priceless insurance and tax strategies

Just $497 for a lifetime of security

Copyright 2025, Eyes Wide Open Life LLC

Privacy Policy | Terms & Conditions

Results cannot be guaranteed and results from individual testimonials are for information only.

Your own results and personal experiences may differ to those shown on this site and depend upon a range of factors.